What Is Social Security Tax? Definition, Exemptions, and Example

Por um escritor misterioso

Last updated 24 janeiro 2025

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

The Social Security tax, levied on both employers and employees, funds Social Security and is collected in the form of a payroll tax or a self-employment tax.

What is Backup Withholding Tax

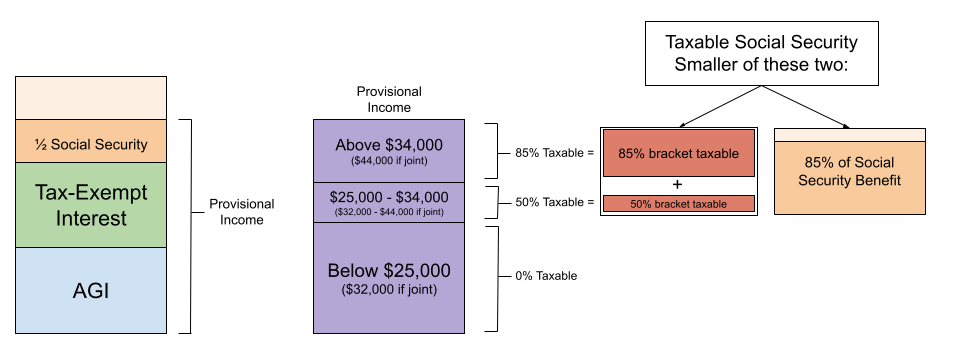

Research: Income Taxes on Social Security Benefits

Requirements for Tax Exemption: Tax-Exempt Organizations

:max_bytes(150000):strip_icc()/USSSCard-ed3cb5248ef842ee89c9ae1bb60e4fbd.jpg)

Who Is Exempt From Paying Into Social Security?

Tax Withholding Definition: When And How To Adjust IRS Tax Withholding

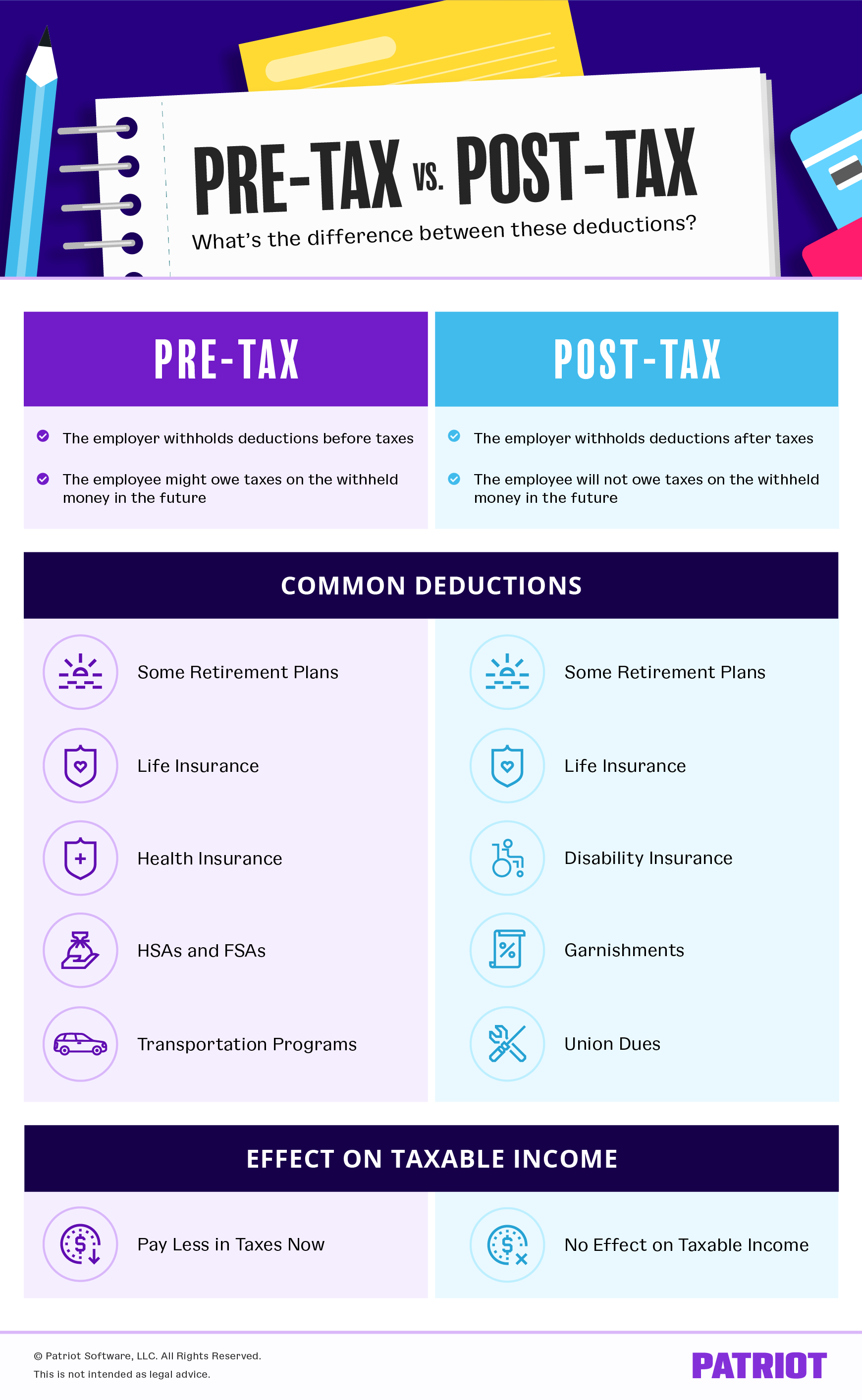

Pre-tax vs. Post-tax Deductions - What's the Difference?

Federal Taxation of Social Security Benefits

Social Security Tax Definition, How It Works, and Tax Limits

Social Security (United States) - Wikipedia

Recomendado para você

-

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png) Learn About FICA, Social Security, and Medicare Taxes24 janeiro 2025

Learn About FICA, Social Security, and Medicare Taxes24 janeiro 2025 -

What is FICA24 janeiro 2025

What is FICA24 janeiro 2025 -

What is the FICA Tax and How Does It Work? - Ramsey24 janeiro 2025

What is the FICA Tax and How Does It Work? - Ramsey24 janeiro 2025 -

Social Security Administration - “What is FICA on my paycheck?” Find out24 janeiro 2025

-

What is the FICA Tax? - 2023 - Robinhood24 janeiro 2025

-

What is a payroll tax?, Payroll tax definition, types, and employer obligations24 janeiro 2025

What is a payroll tax?, Payroll tax definition, types, and employer obligations24 janeiro 2025 -

What Is FICA Tax? —24 janeiro 2025

What Is FICA Tax? —24 janeiro 2025 -

What Eliminating FICA Tax Means for Your Retirement24 janeiro 2025

-

IRS Form 843 - Request a Refund of FICA Taxes24 janeiro 2025

IRS Form 843 - Request a Refund of FICA Taxes24 janeiro 2025 -

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com24 janeiro 2025

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com24 janeiro 2025

você pode gostar

-

One Piece ganha nova sequência de encerramento após 17 anos24 janeiro 2025

One Piece ganha nova sequência de encerramento após 17 anos24 janeiro 2025 -

Magnus Carlsen Stamp Chess Viswanathan Anand Sport S/S MNH #3142 / Bl.35224 janeiro 2025

Magnus Carlsen Stamp Chess Viswanathan Anand Sport S/S MNH #3142 / Bl.35224 janeiro 2025 -

ios Which chess app?24 janeiro 2025

ios Which chess app?24 janeiro 2025 -

6 Websites to Play Free Fun Online Games for Kids24 janeiro 2025

6 Websites to Play Free Fun Online Games for Kids24 janeiro 2025 -

Every Video With QTCinderella : r/atrioc24 janeiro 2025

Every Video With QTCinderella : r/atrioc24 janeiro 2025 -

Nandita D., IELTS and TOEFL mentor (IELTS Academic 8 out of 9), Conversational English, Public Speaking, Storytelling, Business and Strategic Communication Instructor for more than 7 years of experience.24 janeiro 2025

Nandita D., IELTS and TOEFL mentor (IELTS Academic 8 out of 9), Conversational English, Public Speaking, Storytelling, Business and Strategic Communication Instructor for more than 7 years of experience.24 janeiro 2025 -

GameClub offers mobile gaming's greatest hits for $5 per month24 janeiro 2025

GameClub offers mobile gaming's greatest hits for $5 per month24 janeiro 2025 -

Piercing Titânio Umbigo - ANIMO SHOP - Produtos para Pet Shop24 janeiro 2025

Piercing Titânio Umbigo - ANIMO SHOP - Produtos para Pet Shop24 janeiro 2025 -

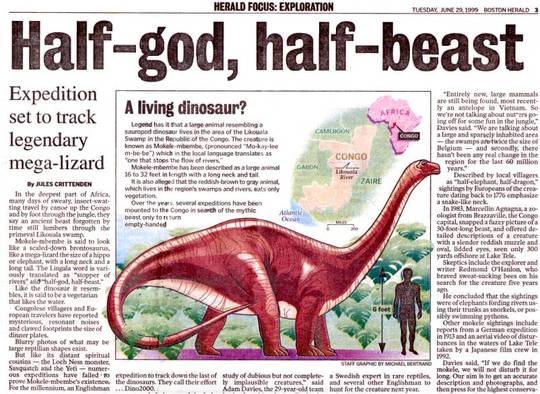

Mokele-Mbembe : Sur Les Traces Du Dernier Dinosaure by Le Comptoir24 janeiro 2025

Mokele-Mbembe : Sur Les Traces Du Dernier Dinosaure by Le Comptoir24 janeiro 2025 -

BloxFlip.com on X: We are doing our BIGGEST #robux #giveaway yet24 janeiro 2025

BloxFlip.com on X: We are doing our BIGGEST #robux #giveaway yet24 janeiro 2025