Publication 970 (2022), Tax Benefits for Education

Por um escritor misterioso

Last updated 06 abril 2025

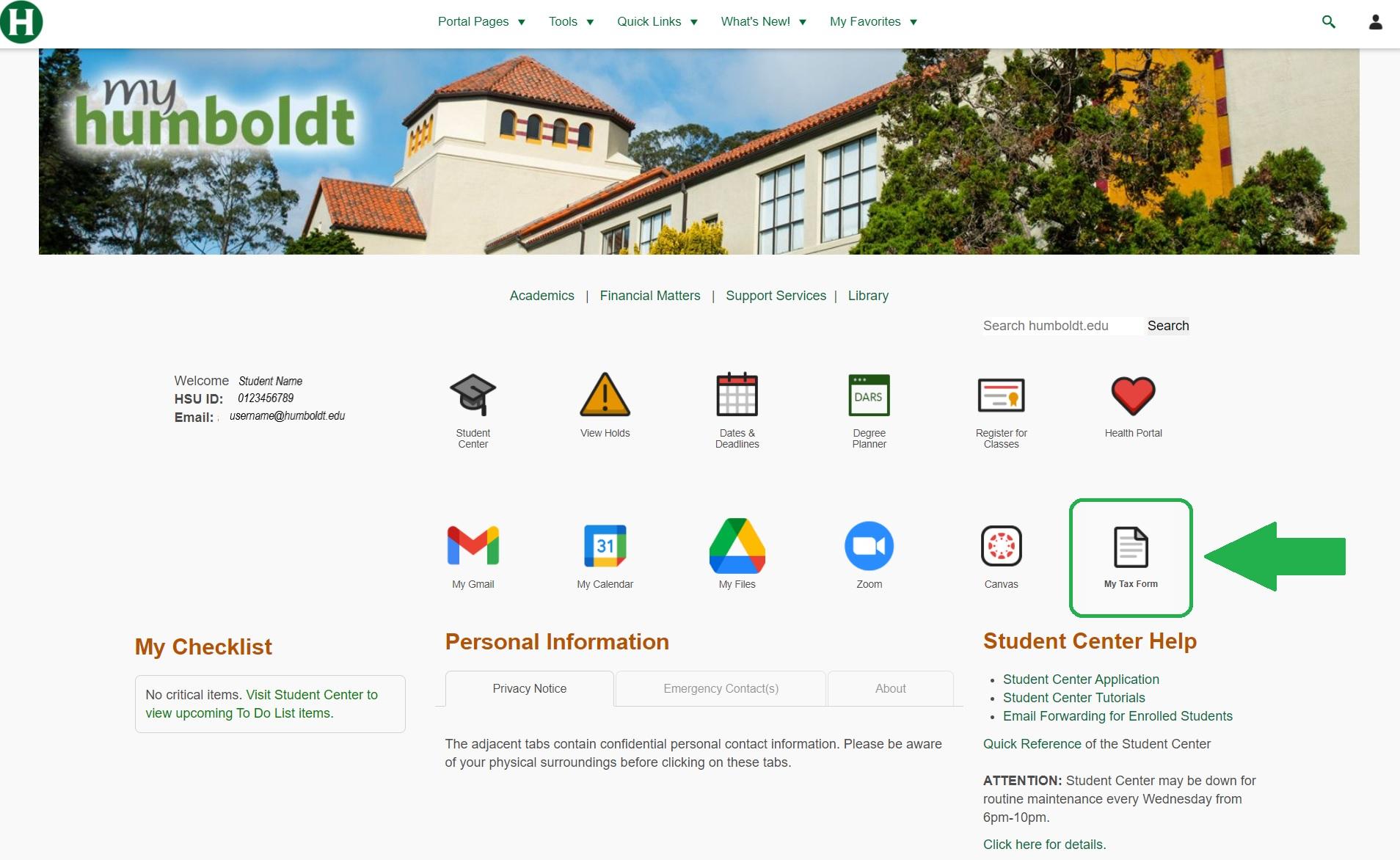

Publication 970 - Introductory Material Future Developments What's New Reminders

:max_bytes(150000):strip_icc()/glasses-4704055_1920-8b09e138284e401587985972c819e2d5.jpg)

IRS Publication 970: Tax Benefits for Education Overview

Publication 970 (2022), Tax Benefits for Education

What Are IRS Publications? - TurboTax Tax Tips & Videos

Educational Credits Covered California MAGI Income publication 970

Educational Credits Covered California MAGI Income publication 970

Education tax credits: Maximizing Savings with IRS Pub 970 - FasterCapital

New 2022 IRS Income Tax Brackets And Phaseouts For Education Tax Breaks

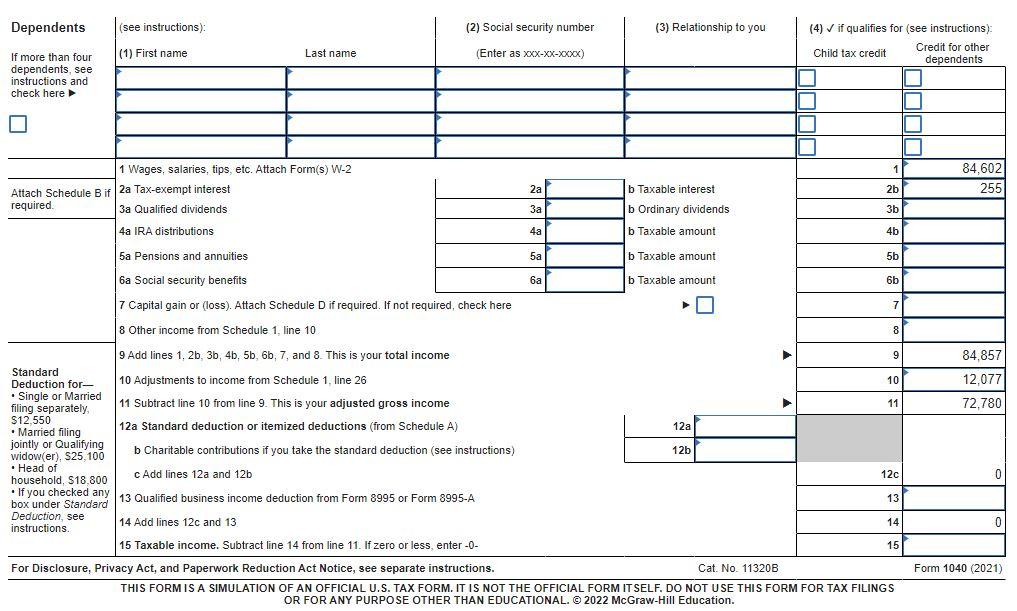

Other Tax Forms and Taxable Income

American Opportunity Tax Credit

IRS Forms 1098-T - Tuition Statement

Educational Tax Credits and Deductions You Can Claim for Tax Year 2022, Taxes

What to know about tax credits for education

Solved Assume the taxpayer does NOT wish to contribute to

Recomendado para você

-

Back to School - Oryu - Webtoons - Lezhin Comics06 abril 2025

Back to School - Oryu - Webtoons - Lezhin Comics06 abril 2025 -

Read Back-to-School Boss :: Episode 106 abril 2025

Read Back-to-School Boss :: Episode 106 abril 2025 -

eero on X: ✏️ Whether they're heading back to campus or studying at your dining table, get the upgrade they need to ace back to school 🎒 Shop now for 20%06 abril 2025

eero on X: ✏️ Whether they're heading back to campus or studying at your dining table, get the upgrade they need to ace back to school 🎒 Shop now for 20%06 abril 2025 -

Fort Worth Water - BACK TO SCHOOL: CHAPTER 1 Fort Worth Water focuses on the math behind local water conservation efforts all this month to help you get ready to save water06 abril 2025

-

13 great back-to school gifts for K-12 from Best Buy - Reviewed06 abril 2025

13 great back-to school gifts for K-12 from Best Buy - Reviewed06 abril 2025 -

Tampa Bay – Tampa Bay NFL Alumni06 abril 2025

Tampa Bay – Tampa Bay NFL Alumni06 abril 2025 -

IHI Open School Chapter at the University of Michigan06 abril 2025

-

Nook buyers getting $100 of free classic books - CNET06 abril 2025

Nook buyers getting $100 of free classic books - CNET06 abril 2025 -

Watch The OA Netflix Official Site06 abril 2025

Watch The OA Netflix Official Site06 abril 2025 -

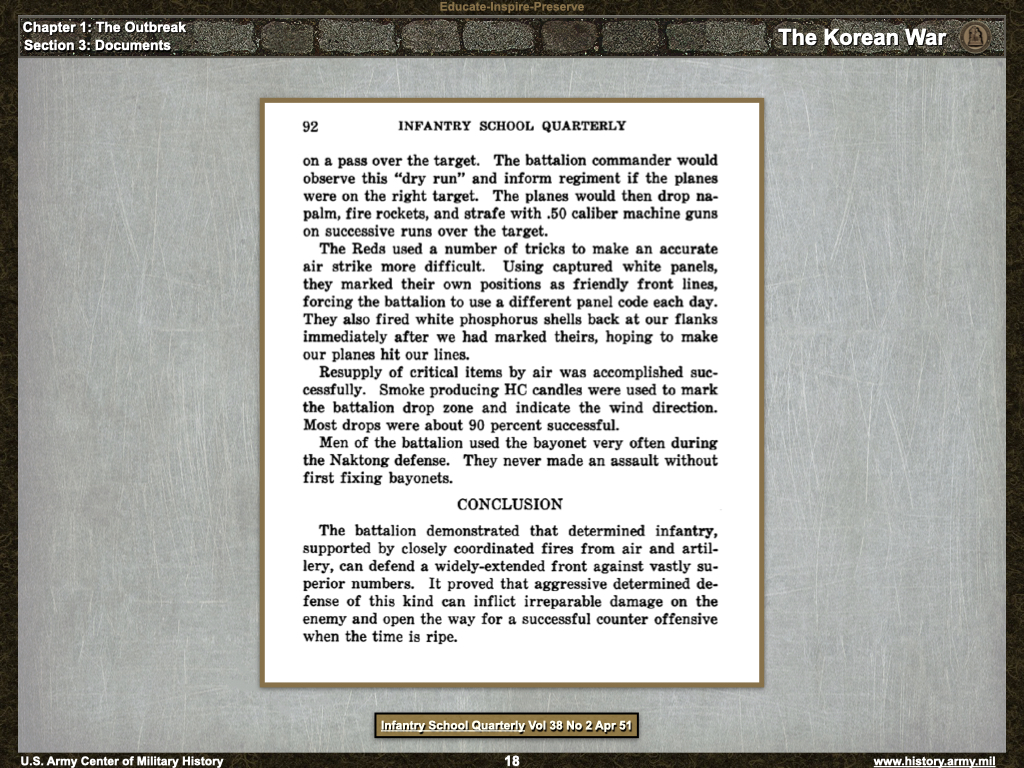

The Outbreak: Documents - The Korean War06 abril 2025

The Outbreak: Documents - The Korean War06 abril 2025

você pode gostar

-

Banda 'A Dama' fará live neste sábado (18) exaltando a diversidade06 abril 2025

Banda 'A Dama' fará live neste sábado (18) exaltando a diversidade06 abril 2025 -

Cheesy All-beef Hotdog Recipe06 abril 2025

Cheesy All-beef Hotdog Recipe06 abril 2025 -

Teste para Mitsuri de Kimetsu No Yaiba (3° Temporada) #kimetsu06 abril 2025

-

Napoleon's Rotten Tomatoes Score Reveals A Surprising Truth About Ridley Scott's 46-Year Movie Career - IMDb06 abril 2025

Napoleon's Rotten Tomatoes Score Reveals A Surprising Truth About Ridley Scott's 46-Year Movie Career - IMDb06 abril 2025 -

PS VR2 Tech Specs PlayStation VR2 display, setup and compatibility (US)06 abril 2025

PS VR2 Tech Specs PlayStation VR2 display, setup and compatibility (US)06 abril 2025 -

Fisherman's Wharf Walking Tour (Self Guided), San Francisco06 abril 2025

Fisherman's Wharf Walking Tour (Self Guided), San Francisco06 abril 2025 -

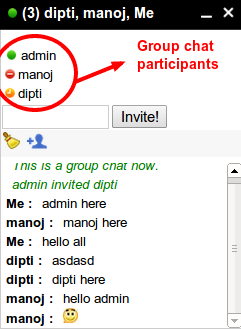

Jbolo 3.0 - alpha 4 - supporting group chat - The Techjoomla Blog06 abril 2025

Jbolo 3.0 - alpha 4 - supporting group chat - The Techjoomla Blog06 abril 2025 -

Pokeball Vector Images (over 380)06 abril 2025

Pokeball Vector Images (over 380)06 abril 2025 -

Soredemo Ayumu wa Yosetekuru - 01 - 11 - Lost in Anime06 abril 2025

Soredemo Ayumu wa Yosetekuru - 01 - 11 - Lost in Anime06 abril 2025 -

Desenhos Animados Mexicano Cacto Flores Deserto Conjunto Suculento Cactos Vetoriais imagem vetorial de Seamartini© 47676538406 abril 2025

Desenhos Animados Mexicano Cacto Flores Deserto Conjunto Suculento Cactos Vetoriais imagem vetorial de Seamartini© 47676538406 abril 2025