Online gaming industry for 28% GST on gross gaming revenue not on entry amount

Por um escritor misterioso

Last updated 10 abril 2025

GGR is the fee charged by an online skill gaming platform as service charges to facilitate the participation of players in a game on their platform while Contest Entry Amount (CEA) is the entire amount deposited by the player to enter a contest on the platform.

GST On Contest Entry Amount For Online Gaming Not In Line With The

Explained Will 28% GST on online gaming affect its growth? - The

28% GST on entry level bets in online gaming, casinos

Will the implementation of 28% GST rate put the brakes on online

28% GST will prove to be catastrophic for the gaming industry, say

Storyboard18 GST of 28% on online gaming would put survival of

THE GREAT GAMBLE Centre's decision to levy 28% GST on online

Online Gaming Industry Asks For GST To Be Levied Only On Gross

Indian Online Gaming Market in Doldrums: 28% GST Could Be

Are Indian Gaming companies 'Gamed' in GST Evasion ?

Recomendado para você

-

5 Free Online Game Platforms To Play With Your Friends10 abril 2025

5 Free Online Game Platforms To Play With Your Friends10 abril 2025 -

Which Platform Is Better For Online Gaming10 abril 2025

Which Platform Is Better For Online Gaming10 abril 2025 -

Online Gaming Platforms An Effective Tool For Children During COVID 19 - BW Wellbeingworld10 abril 2025

Online Gaming Platforms An Effective Tool For Children During COVID 19 - BW Wellbeingworld10 abril 2025 -

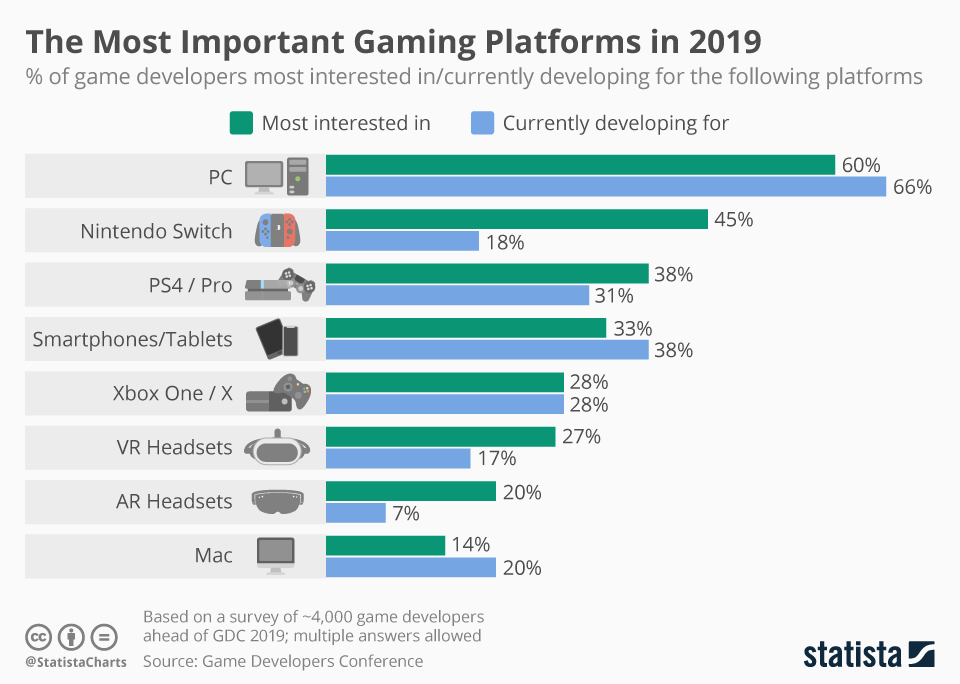

Chart: The Most Important Gaming Platforms in 201910 abril 2025

Chart: The Most Important Gaming Platforms in 201910 abril 2025 -

Expert insights: How does one upskill their talent on an online gaming platform?10 abril 2025

Expert insights: How does one upskill their talent on an online gaming platform?10 abril 2025 -

Expand Your Game with Cross-Platform Access10 abril 2025

Expand Your Game with Cross-Platform Access10 abril 2025 -

How online gaming industry is growing so fast in 2023, David M10 abril 2025

-

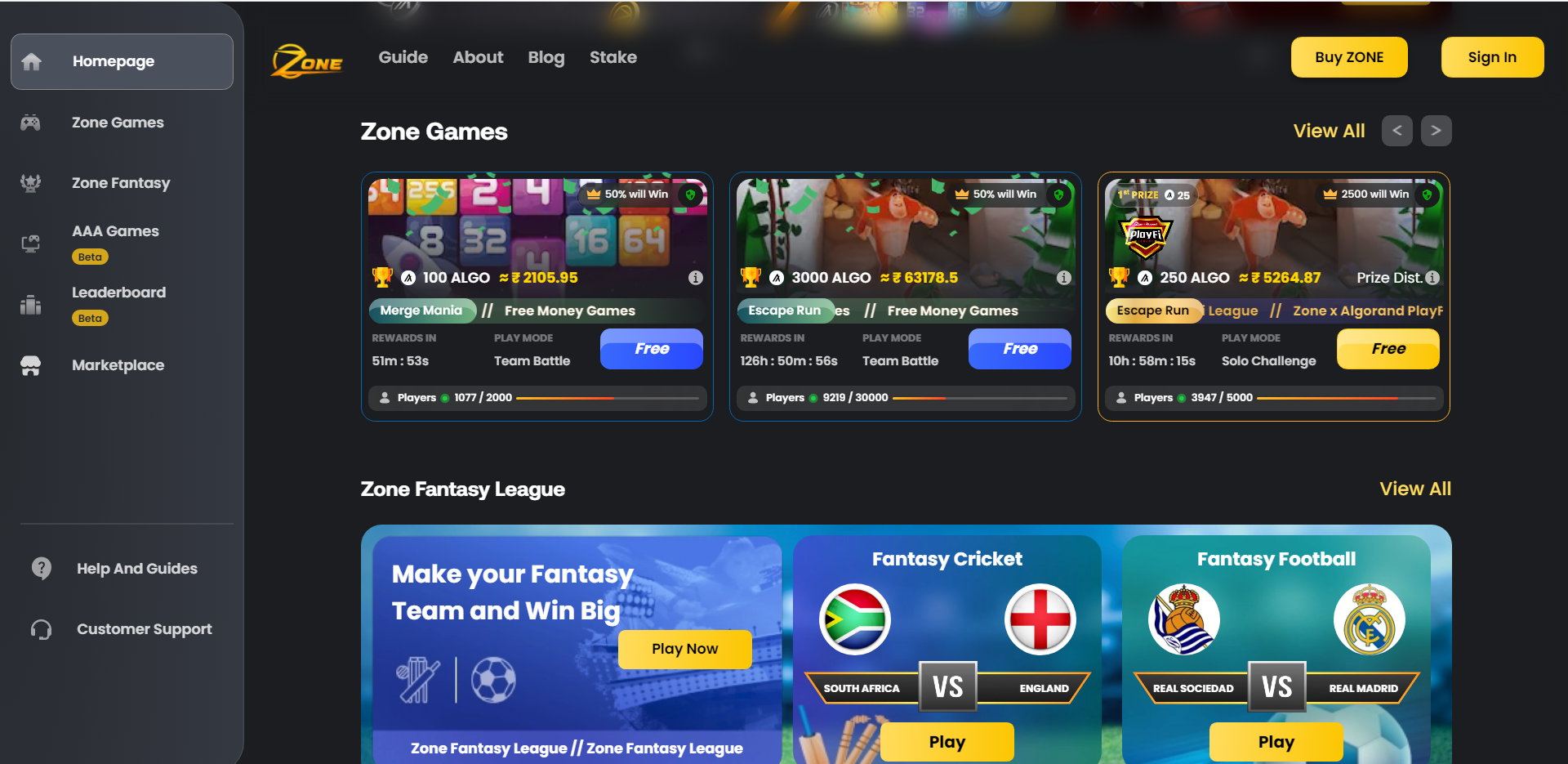

Get Paid to Play: The Best Online Gaming Platform for Easy Money10 abril 2025

Get Paid to Play: The Best Online Gaming Platform for Easy Money10 abril 2025 -

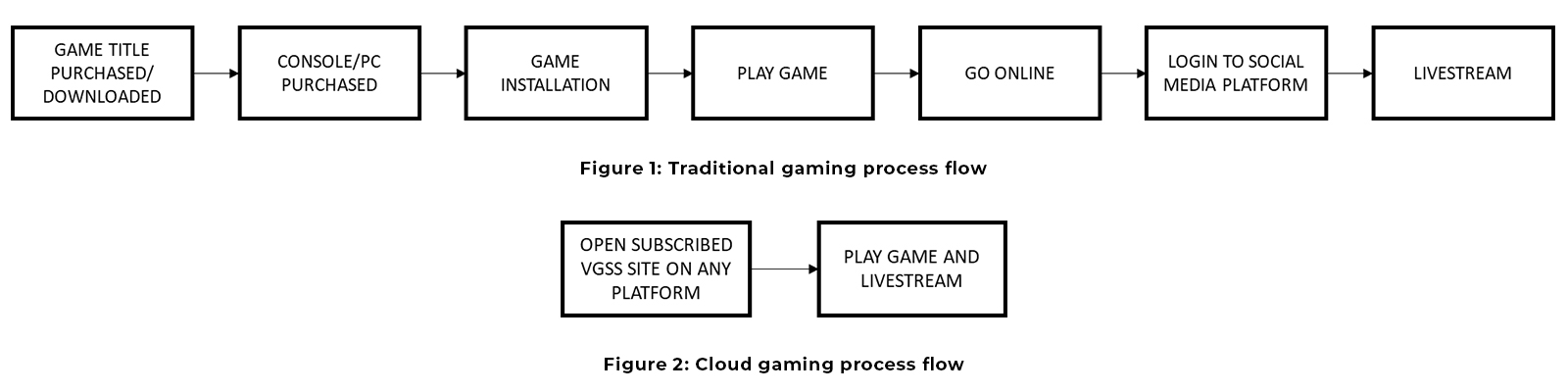

Video Game Streaming Service Benefits Challenges10 abril 2025

Video Game Streaming Service Benefits Challenges10 abril 2025 -

Discord adds video game streaming to chat, text features on Aug. 1510 abril 2025

Discord adds video game streaming to chat, text features on Aug. 1510 abril 2025

você pode gostar

-

Animes Memes 8# •Anime Whatever• Amino10 abril 2025

Animes Memes 8# •Anime Whatever• Amino10 abril 2025 -

Help! I'm a 'Marvel Snap' addict! - GeekDad10 abril 2025

Help! I'm a 'Marvel Snap' addict! - GeekDad10 abril 2025 -

Anand-Carlsen, Game 9: Liquid hydrogen10 abril 2025

-

PlayStation on X: PlayStation 5 Showcase broadcasts live this Wednesday at 1pm Pacific Time: / X10 abril 2025

PlayStation on X: PlayStation 5 Showcase broadcasts live this Wednesday at 1pm Pacific Time: / X10 abril 2025 -

Primeiras Impressões: Hyakuren no Haou to Seiyaku no Valkyria10 abril 2025

Primeiras Impressões: Hyakuren no Haou to Seiyaku no Valkyria10 abril 2025 -

Jogando Roblox - Roblox City - Parte 110 abril 2025

Jogando Roblox - Roblox City - Parte 110 abril 2025 -

Baixar ISO PSP Jogos em Português - Download Grátis ROMs10 abril 2025

Baixar ISO PSP Jogos em Português - Download Grátis ROMs10 abril 2025 -

Anime Weapon Simulator codes10 abril 2025

Anime Weapon Simulator codes10 abril 2025 -

College Football Playoff expert picks: Will Texas be No. 3? Should10 abril 2025

College Football Playoff expert picks: Will Texas be No. 3? Should10 abril 2025 -

Manualidades Con Papel Navidad Copos de nieve de papel, Hacer copos de nieve de papel, Copos de nieve10 abril 2025

Manualidades Con Papel Navidad Copos de nieve de papel, Hacer copos de nieve de papel, Copos de nieve10 abril 2025