How An S Corporation Reduces FICA Self-Employment Taxes

Por um escritor misterioso

Last updated 24 janeiro 2025

How an S corporation can reduce FICA taxes, the criteria for qualifying for FICA-exempt S corporation dividends, and why an S corp may not always be best.

Have Your LLC Taxed as an S Corp - S Corp Election Form 2553

2023 Tax Tips for Videographers & Photographers: LLC Self Employment Tax — Core Group

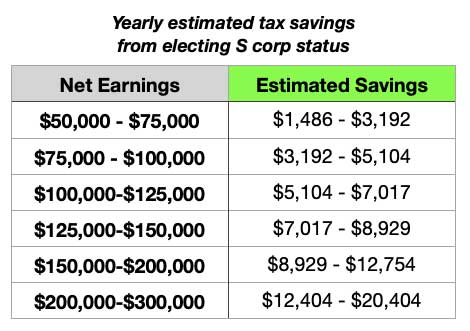

Here's How Much You'll Save In Taxes With an S Corp (Hint: It's a LOT)

Do LLC Owners Pay Self-Employment Tax?

FICA Tax in 2022-2023: What Small Businesses Need to Know

Taxation of an S-Corporation: The Why (Benefits) & How (Rules)

LLC vs S Corp: The Difference and Tax Benefits — Collective Hub

💰 Should I Take an Owner's Draw or Salary in an S Corp? - Hourly, Inc.

How a CRNA S Corporation Can Reduce Your FICA Self-Employment Taxes

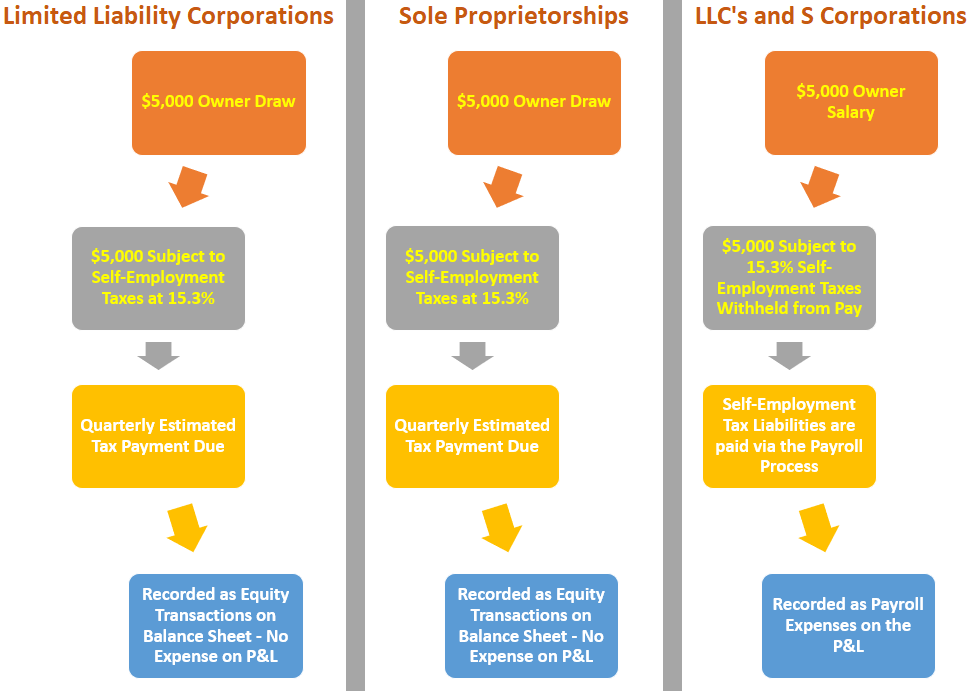

Understand How Small Business Owners Pay Themselves & Track Self-Employment Tax Liabilities - Lend A Hand Accounting

Recomendado para você

-

What is FICA24 janeiro 2025

What is FICA24 janeiro 2025 -

FICA Tax: What It is and How to Calculate It24 janeiro 2025

FICA Tax: What It is and How to Calculate It24 janeiro 2025 -

What is the FICA Tax and How Does It Work? - Ramsey24 janeiro 2025

What is the FICA Tax and How Does It Work? - Ramsey24 janeiro 2025 -

FICA Tax: What is FICA Tax, Rates, Exemptions and Calculations24 janeiro 2025

FICA Tax: What is FICA Tax, Rates, Exemptions and Calculations24 janeiro 2025 -

Family Finance Favs: Don't Leave Teens Wondering What The FICA?24 janeiro 2025

Family Finance Favs: Don't Leave Teens Wondering What The FICA?24 janeiro 2025 -

FICA Tax: Understanding Social Security and Medicare Taxes24 janeiro 2025

-

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet24 janeiro 2025

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet24 janeiro 2025 -

What Eliminating FICA Tax Means for Your Retirement24 janeiro 2025

-

IRS Form 843 - Request a Refund of FICA Taxes24 janeiro 2025

IRS Form 843 - Request a Refund of FICA Taxes24 janeiro 2025 -

FICA Tax Tip Fairness Pro Beauty Association24 janeiro 2025

FICA Tax Tip Fairness Pro Beauty Association24 janeiro 2025

você pode gostar

-

Ian Nepomniachtchi: from an 8-year photo with Anatoly Karpov 2224 janeiro 2025

Ian Nepomniachtchi: from an 8-year photo with Anatoly Karpov 2224 janeiro 2025 -

Trailer da 3ª temporada de Blue Exorcist traz festival, batalhas e24 janeiro 2025

Trailer da 3ª temporada de Blue Exorcist traz festival, batalhas e24 janeiro 2025 -

Highest Imdb Rated Tv Shows24 janeiro 2025

-

2d-game-engine · GitHub Topics · GitHub24 janeiro 2025

-

5 vagas disponíveis. 📢📢📣 #vagadeemprego #angolanos #foryoupage24 janeiro 2025

-

1988 Honda CBX 750 For Sale24 janeiro 2025

1988 Honda CBX 750 For Sale24 janeiro 2025 -

Boruto Episode 287 Release Date And Time24 janeiro 2025

Boruto Episode 287 Release Date And Time24 janeiro 2025 -

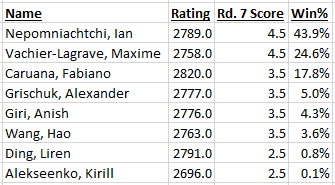

2021 Candidates Tournament – Event Preview24 janeiro 2025

2021 Candidates Tournament – Event Preview24 janeiro 2025 -

Five Nights In Anime APK 2023 latest 4.3.1 for Android24 janeiro 2025

Five Nights In Anime APK 2023 latest 4.3.1 for Android24 janeiro 2025 -

Steve Lopez, Harvest Town Wiki24 janeiro 2025

Steve Lopez, Harvest Town Wiki24 janeiro 2025